If you have any prior misdemeanors or felonies, this may affect the outcome of your licensing efforts. Giving your fingerprints will initiate a background check. The State of Texas requires that all insurance license applications provide fingerprints prior to licensing. You may register to take your exams and find more information on the Pearson VUE Texas Insurance page or by calling Pearson VUE at (888) 754-7667. The exams are difficult enough on their own without confusing information from one line to another.Ĭheck out our review of the ExamFX Insurance Course. Tip: StateRequirement recommends that you study for one exam at a time, then after passing, starting on your next line. We will quote Pearson VUE’s Texas Department of Insurance Licensing Candidate Handbook to explain scoring: Here is a copy of the exam content outline for all the insurance lines that are being offered in Texas. There are no limits on attempts at each exam per year, but once you pass, you must apply for the license within twelve (12) months or retake the test. The Life, Accident & Health exam and the Property & Casualty exams consist of one hundred thirty (130) questions.

The fee for each attempt of the exams is $43 (one exam per combined lines of authority). When you show up you must have a photo ID any other documents that the testing facility has asked you to bring. One great way to get some experience with insurance testing is taking an insurance practice exam. For people who haven’t tested in a situation like this should be aware of this fact, and work on taming their nerves prior to sitting for the exam. This is a proctored test, which means that you will be in a controlled environment with a person watching over you. Life & Health and Property & Casualty lines are two combined lines in Texas, so you will take two exams if you wish to attain all of these lines of authority: Property, Casualty, Life, Accident, Health. You will take one exam for each line of insurance you wish to carry. The next step after completing all of your pre-license coursework or self-study is to take the insurance exam. You can find more information on becoming an insurance adjuster here: Texas Insurance Adjuster Licenseįor required insurance pre-license courses and exam prep, StateRequirement recommends: Insurance adjusters require a separate license. Most insurance agents and producers choose to get both P&C and L&H licenses, but if you plan on specializing in only one category then you don’t need every license.

#Dismantler license texas how to#

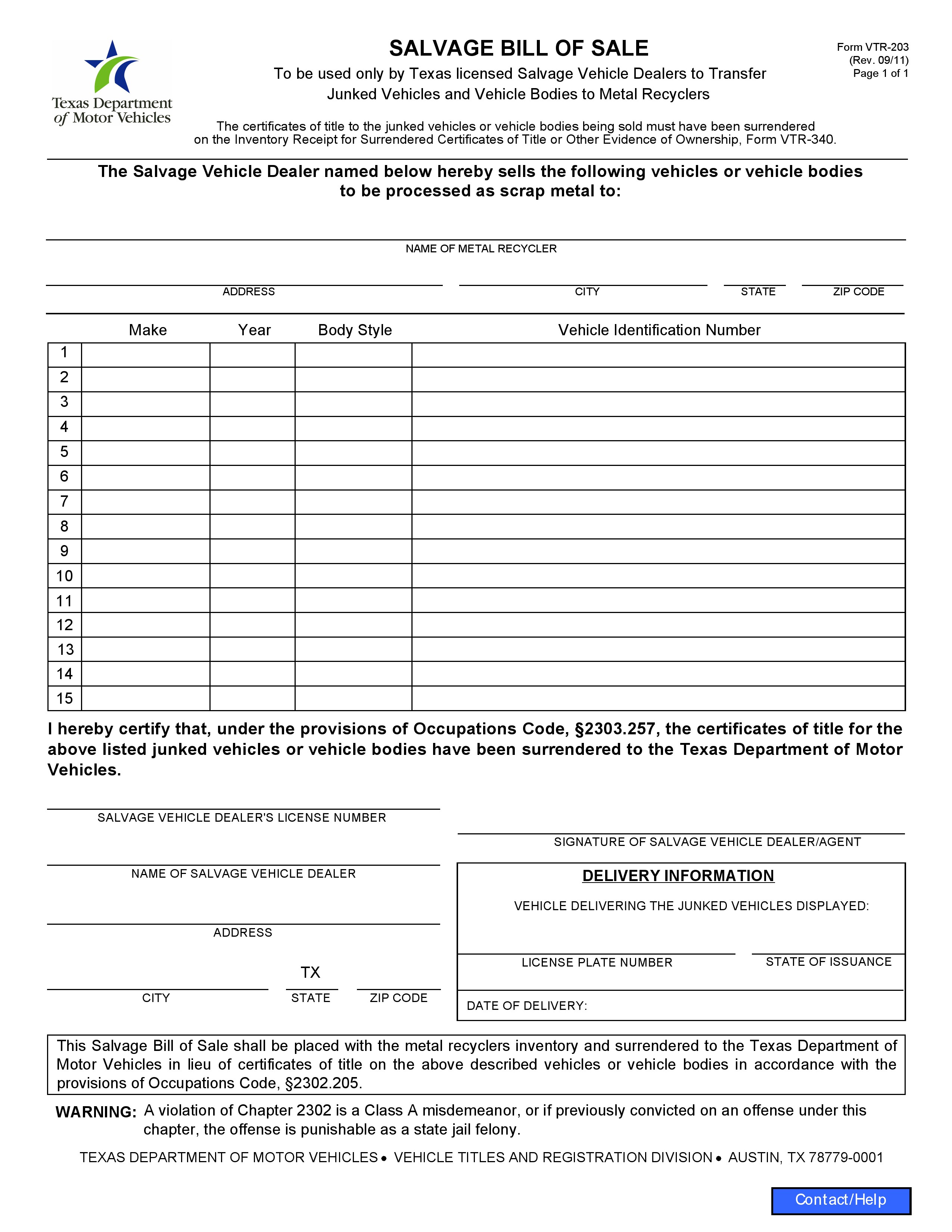

The Texas Department of Insurance has a 6-step process on how to become an insurance agent in Texas. Whether you’re interested in selling property and casualty insurance, life insurance, health insurance, or any combination of those lines of authority, this article has the information you need to get started. Case Report Number Agent Name ID Number Date Time Business Name Address Lead Agent conducting inspection.Getting your Texas insurance license is the first step to becoming an insurance agent in Texas. The RSD-5 will also be utilized to complete all necessary weekly and monthly reports and shall be submitted at the close of each calendar month. The Salvage/MRE Inspection Report will be referred to as the RSD-5. Texas Department of Public Safety MUST USE MOST CURRENT FORM SALVAGE YARDS Regulatory Services Division FORM MUST BE TYPED METALS INSTRUCTIONS FOR COMPLETING THE SALVAGE/MRE INSPECTION REPORT The Salvage/MRE Inspection Report will be utilized to document and report all inspections conducted at Licensed or Unlicensed Salvage locations and Licensed or Unlicensed Metal Recycling Entities.

0 kommentar(er)

0 kommentar(er)